Lending

Homeownership is the primary means for most Americans to build wealth, and lack of access to homeownership greatly impacts long-term financial needs, retirement, and generational wealth. Unfortunately, many people may experience barriers to their access of mortgage products. The FHCCI has been active since 2015 in promoting equal access to credit for all, making significant investment to build and expand homeownership opportunities.

Types of housing discrimination in mortgage lending may include:

- A bank closing its bank branches only in neighborhoods of color or not conducting outreach in neighborhoods of color while doing outreach in white neighborhoods.

- A mortgage lender refusing to approve a loan unless a borrower on parental leave returned to work.

- A company targeting persons of color or neighborhoods of color with predatory lending products.

- A mortgage lender requiring intrusive and unnecessary medical records to prove disability based income or subsidies.

- An appraiser adding references into their appraisal documents about the neighborhood demographics or past racial or ethnic history to justify an appraisal outcome.

Mortgage Lending Spotlight – HMDA Spreadsheets

As referenced in the FHCCI’s December 18, 2025 press release, below are premade HMDA excel spreadsheets available through our data portal (with FHCCI notes added). Note: File will download so check your downloads folder:

FHCCI Resources:

- FHCCI videos on historic inequities and modern day forms of lending bias or discrimination:

- History of Redlining

- The History of Real Estate Sales Discrimination

- Reverse Redlining 101

- 8 Modern Day Forms of Lending Housing Discrimination

- Community Voices

- Fact Sheet #10: Fair Lending: Frequently Asked Questions

- FHCCI reports on mortgage lending challenges and barriers with recommendations to combat harms:

- Mortgage Lending in Marion County 2018-2020 (2022)

- FHA & VA Mortgage Lending in Marion County 2018-2021 (2022)

- The Impact of Investors, Foreclosures, and Mortgage Lending (2022)

- Mortgage Lending Update for Marion County 2021-2022 (2024)

- The Fair Housing Challenges for Manufactured Housing Residents (2024)

- Land Contracts: The Promise and Perils of Alternative Home Financing (2024)

- Mortgage Lending in Allen County 2023 (2025)

- Who Owns Central Indiana’s Houses: An Update of the Largest Single-Family Home Investors (2025)

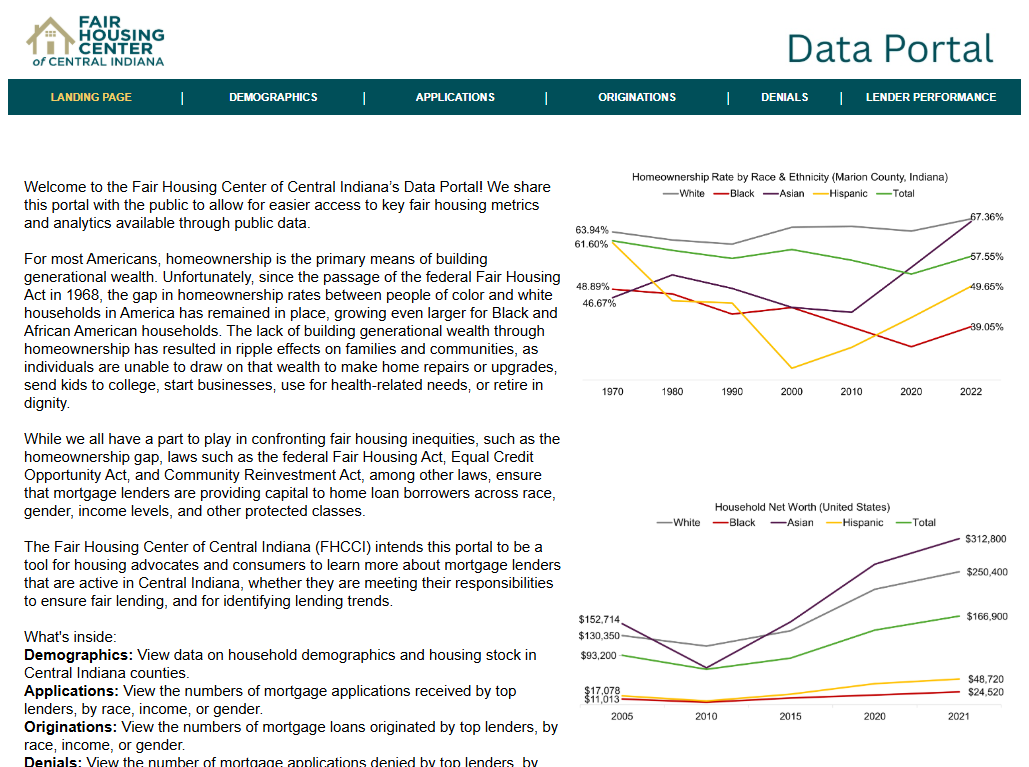

- Explore the FHCCI data portal to review and download public data released through the U.S. Census and the Home Mortgage Disclosure Act (HMDA) for 20 Indiana counties and/or by mortgage lender.

- Review other FHCCI topical pages on mortgage lending issues including Appraisals, Lending, and Rent to Own/Land Contracts.

- Brochures and Fact Sheets related to mortgage lending:

- FHCCI Fact Sheet 12 – Fair Lending Frequently Asked Questions

- FHCCI Brochure – Resources for Homebuyers (English/Spanish)

- FHCCI Brochure – Utility Assistance for Homeowners (English/Spanish)

- FHCCI Brochure – Foreclosure Resources (English/Spanish)

- FHCCI Brochure – Home Repairs and Modifications (English/Spanish)

- FHCCI Brochure – Homeowner’s Insurance (English/Spanish)

- FHCCI Brochure – Land Contracts/Alternative Financing to Purchase a Home (English/Spanish)

Redlining Maps (Home Owners’ Loan Corporation):

As part of the New Deal, in 1933, a government agency was created called the Home Owner’s Loan Corporation (HOLC). This agency was charged with helping expand homeownership opportunities. As part of their efforts, the HOLC created maps for many major U.S. cities to determine where the new government backed mortgage loans should, or should not, be made. Some of the factors that determined neighborhood ratings for a map, was the income of the residents as well as their race, ethnicity, and religion. These maps are commonly known today as “redlining maps” because of the use of “redlines” around the lowest graded neighborhoods. Their use helped to create the substantial homeownership and appraisal gap we see today based on race and ethnicity. Although the use of these maps was banned in 1968 with the passage of the federal Fair Housing Act, their impact is still evident today. For us in Indiana, several of our cities had redlining maps created that were used during the post-World War II homeownership boom:

- Evansville (1937)

- Hammond (1937)

- Indianapolis (1937)

- Muncie (1937)

- South Bend and Mishawaka (1937)

- Terre Haute (1937)

- You can also review the notes which were used for grading neighborhoods at Mapping Inequality

Government Guidance & Resources:

- Community Reinvestment Act

- FDIC Fair Lending

- HUD-OIG Loan Modification Fraud Bulletin, June 2020

- HUD Predatory Lending Brochure

- HUD Guidance on Application of the Fair Housing Act to the Advertising of Housing, Credit, and Other Real Estate-Related Transactions through Digital Platforms, April 29, 2024 (Rescinded September 17, 2025)

- HUD Memo – Special Purpose Credit Programs, December 6, 2021 (Rescinded September 17, 2025)

- HUD Program Eligibility for HUD Assisted and Insured Housing Programs for All People Regardless of Sexual Orientation, Gender Identity or Marital Status as Required by HUD’s Equal Access Rule, February 6, 2015

- Consumer Finance Protection Bureau: CFPB’s mission is to make markets for consumer financial products and services work for Americans — whether they are applying for a mortgage, choosing among credit cards, or using any number of other consumer financial products. Complaints may be filed with them on alleged violations.

- Using special purpose credit programs to serve unmet credit needs, July 19, 2022

- An Updated Review of the New and Revised Data Points in HMDA, August 2020

- CFPB Guidance – Income from the Section 8 Housing Choice Voucher Homeownership Program shouldn’t mean you don’t qualify for a mortgage, May 11, 2015

- CFPB Report Highlights Consumer Frustration Around Reverse Mortgages, February 9, 2015

- CFPB Guidance to Help Lenders Avoid Discrimination Against Consumers Receiving Disability Income, November 18, 2014

Cases of Interest:

- Fair Housing Center of Central Indiana v. Old National Bank (2021)

- U.S. v. First Merchants Bank (2019)

- U.S. v. Union Savings Bank and Guardian Savings Bank (2017)

- HOPE Fair Housing Center v. Alpine Bank & Trust Co. (2017)

- U.S. v. KleinBank (D. Minn.) (2017)

- Metro St. Louis Equal Housing and Opportunity Council/Legal Aid of Western Missouri v. First Federal Bank of Kansas City (2016)

- U.S. and Consumer Financial Protection Bureau v. BancorpSouth Bank (2016)

- National Community Reinvestment Coalition v. First Tennessee Bank (2016)

- U.S. v. Eagle Bank and Trust Company of Missouri (2015)

- CFPB & United States v. Hudson City Savings Bank, F.S.B. (2015)

- City of Providence, RI v Santander (2014)

- New York v. Evans Bancorp Inc., (2014)

- Cities of Baltimore and Memphis v. Wells Fargo (2012)

Reports of Interest:

- Mapping Inequality: Redlining in New Deal America – website with a number of city maps of the Home Owners Loan Corp. Also includes HOLC neighborhood descriptions.

- The Secret Bias Hidden in Mortgage-Approval Algorithms, The Mark Up, August 2021

- How 1930s discrimination shaped inequality in today’s cities, National Community Reinvestment Coalition, 2018

-

Historic HOLC Redlining in Indianapolis and the Legacy of Environmental Impacts, Journal of Public and Environmental Affairs, April 2020

- Historical Injustice in the Urban Environment: The Ecological Implications of Residential Segregation in Indianapolis, Indiana Legal Archive

- Lending Discrimination Disparities, Reveal from the Center for Investigative Reporting 2018

Other Mortgage Lending Issues:

- Appraisals: Learn more at our Appraisals page.

- Foreclosure Rescue/Mortgage Scams:

- REOs (Real Estate Owned Properties/Foreclosures) Maintenance and Sale:

- Here Comes The Bank, There Goes Our Neighborhood: How lenders discriminate in the treatment of foreclosed homes, National Fair Housing Alliance, April 11, 2011

- The Banks Are Back – Our Neighborhoods Are Not: Discrimination in the Maintenance and Marketing of Foreclosed Properties, National Fair Housing Alliance, April 4, 2012

- Zip Code Inequality: Discrimination by Banks in the Maintenance of Foreclosed Homes in Neighborhoods of Color, National Fair Housing Alliance, September 3, 2014

- Rent to Own/Land Trust/Land Contracts: Learn more at our Rent to Own/Land Contract page.

- Reverse Mortgages:

- OIG Reverse Mortgage Fraud Bulletin, August 2020

- Reports of Interest:

- Cases of Interest:

Other Lending Laws of Interest:

- Community Reinvestment Act

- Equal Credit Opportunity Act

- Indiana High Cost Home Loan Law: Fact Sheet describing 2004 law.

If you feel that you may have been discriminated against in a lending situation due to your race, color, national origin, religion, gender, disability, or familial status, please contact the FHCCI. If you need assistance not related to discrimination regarding a loan modification, refinancing, or otherwise, please consider contacting a HUD certified housing counseling agency.

In order to understand how a city’s neighborhoods may be so different, it is important to learn about historic policies which may be still impacting these neighborhoods today. One such policy action this FHCCI video focuses on is a practice called “redlining.”

Visit the FHCCI Data Portal to review Home Mortgage Disclosure Act (HMDA) data for lenders in your county.

In this FHCCI video, learn about racial covenants and the historic actions of the real estate industry that impacted the ability to become a homeowner due to race, color, national origin, and religion.

In this FHCCI video, learn about predatory lending practices and products which may violate fair housing laws and are commonly referred to as forms of “reverse redlining.”

Housing discrimination in the mortgage lending market can come in a variety of forms. This FHCCI video reviews eight kinds of discrimination that the FHCCI most often encounters in mortgage lending.

When the Fair Housing Act was passed in 1968, it made it unlawful to discriminate in housing transactions due to protected classes. Unfortunately, what the Fair Housing Act couldn’t do was fix the systemic housing discrimination that had already been done to communities across the country. In this video, learn about the activities of the FHCCI and area organizations to try to combat historic exclusion.